In the previous article we looked at the Cradle to Grave organization structure and the common compensation approaches used to go along with those roles. Now we will look at the Split Model, the roles commonly found in this model, and how they should be paid (spoiler…paying everyone a commission (% of the load), while common, is suboptimal).

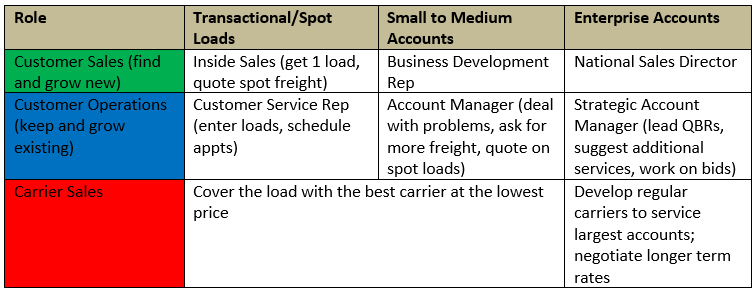

The split model typically starts when Customer Sales and Carrier Sales are separated into different groups. Some companies call Carrier Sales “Operations”, while others reserve that term for yet another split off group – Customer Operations. Customer Operations provides support to Customer Sales by doing order entry, scheduling, and simple problem resolution. Customer Operations may also include highly sophisticated Account Managers whose job is to manage and grow very large customer accounts. These Account Managers are sales roles, make no mistake; they are just hunting at the zoo rather than in the wild, and usually don’t (and shouldn’t) have any cold calling expectation put on them. Cold Calling is not their job. In very big organizations you may also get a separation of the customer sales roles based on the size of the customer - with terms like Enterprise Sales, SMB (Small to Medium Business) Sales, Inside Sales or Lead Generation roles, Customer Support, and various levels of Account Management (Enterprise to SMB divisions can be found here as well). The table below might help you understand how all this plays out, using some generic titles that might be found in these roles and a generic understanding of basic duties.

Because so many companies organize differently (and use different terms), I’ve found that color coding the roles on an org chart can really improve clarity. Green is used for hunting new customers (i.e. cold calling), blue for farming existing customers (and growing them), and red for carrier sales. I also use brown for the more clerical duties such as entering loads, scheduling appointments, as well as track and trace (though these are very commonly blended with higher level duties so you will have various combinations with Customer Ops and Carrier Sales). To round things out, I use Yellow for managers, and Purple for Back Office roles. If you have a Carrier Development and/or Carrier On-Boarding function, you can use Orange there.

When a company evolves from a cradle to grave model that pays one person a commission (% of GM$), the knee-jerk reaction is to divide the % paid among the different roles. This leads to customer service reps being paid 0.50% of the GM$ because they are supporting such a big book of accounts or are working on a team where it is difficult to really parse out specific individual duties. Likewise, managers may be getting a % of the GM$ produced by the team. Neither of these approaches is ideal. A true commission (% of GM$) should only be used for the role that has direct, individual, influence on the value the company receives from the negotiation with the customer or carrier. In the above chart, this means it should only be used for Customer and Carrier Sales roles, and in some limited cases for more sophisticated Blue roles, provided there is a way to track account GROWTH and not simply pay a commission for an account handed to someone to manage (thank you Santa Claus). This does not mean that the blue, brown, yellow, and maybe even orange roles shouldn’t be paid an uncapped, frequently paid incentive. It just means it should be done in a different way.

Many people are familiar with “goal-based” or “quota” or “attainment to goal” plans, and unfortunately have had bad experiences with them. What they don’t realize is that sales reps the world over are commonly paid using monthly or quarterly attainment to goal plans, and these plans may contain these same features found in commission plans:

1) They can be uncapped with unlimited earnings potential

2) They can be paid frequently (monthly is common from a practical standpoint)

3) They can be based on individual performance using an unambiguous mathematical formula (not subject to management discretion)

4) They can be as lucrative (if not more lucrative) than a straight-line commission plan

5) They do not have to be overly sensitive to the goal which is set (if you use a wide performance range with a 1:1 slope (e.g., 50% of goal pays 50% of the incentive, 150% of goal pays 150% of the incentive) then this will feel very much like a straight line commission plan and it won’t matter so much if the goal was wildly wrong, provided you use some good economic testing in how you set the goal in the first place

a. If you are converting from a commission plan, take the typical amount paid for the role and divide it by the current commission rate. This will give you the minimum goal you should set under the new plan. If you set the goal much lower than this, I guarantee someone in Finance will question the wisdom of this new plan.

The next article will break down different types of commission and goal-based plans so you can start to see how commissions make sense for some roles (but not others) and goal-based plans are the best approach for other roles. In future articles we will get into some of the hybrid approaches (it’s possible to have a goal-based commission, or a goal-based plan that becomes a commission above a certain performance level). There are many variations that are possible beyond just x% for customer operations, x% for carrier sales, and x% for customer sales. There are even ways to add a second metric (hello Load Count!) to any of these types of plans.

Beth Carroll is the founding partner of Prosperio Group, a compensation development firm that helps transportation & logistics companies use compensation to drive profitable growth through enhanced employee motivation and rewards. Beth is based in Chicago, IL and has over 25 years’ experience developing incentive compensation plans for companies across the globe in a variety of industries. Beth and her team have designed plans for more than 500 Transportation & Logistics companies. Beth can be reached at 815-302-1030 or via email at beth.carroll@prosperiogroup.com.