Why Compensation Trends Are Important

The employment rate reports from the summer indicates the US is approaching “full-employment” with almost as many willing and able workers as there are jobs. Compensation professionals like me pay careful attention to these statistics – whichever way they are moving – as they indicate the need for companies to re-examine their total rewards packages to adjust to the changing market conditions. Some areas of the country and some industries are having an especially challenging time. A professional colleague of mine who tracks job listings and entry pay rates told me recently that construction workers in the Pacific Northwest are in such short supply that construction projects are being put on hold. We all know there is a shortage of truck drivers, and this is only forecast to get worse.

Making compensation predictions can be difficult – particularly in volatile political and economic times, and always within the transportation industry which tends to be highly sensitive to slight economic changes. This time last year nearly every compensation conversation centered around the new FLSA regulations and what to do about them. Practically no one expected that a year later, the issue would be, to quote my kids, “meh.” Many companies made changes to address the proposed new salary requirements, and nearly all companies now understand that there is something called the “duties test” that comes into play regardless of salary level.

So, what does it look like is going to happen for 2018 in terms of compensation? While I can’t say I have a perfect crystal ball, looking back through the past few years of compensation surveys that Prosperio has provided for the TIA can provide some interesting trend indicators. Looking at the Carrier Sales role, we can see some very significant pay trends since 2011.

2016 Pay Data

Note: 50th = median pay level (half of employees are above this level, half are below). 25th = 25% of employees are below this level and 75% of employees are above this level. 75th = 75% of employees are below this level and 25% of employees are above this level.

Graphing trends over all the years can also help us see forward:

The entry level base salary rate has increased 9% between 2011 and 2016, an average annual rate of 1.8%. The senior level base salary rate has increased 31%, an average annual rate of 6.2%. But, as the graph makes clear, these gains came almost entirely in the last two years with 14% and 13% increases in 2015 and 2016, respectively.

Total compensaiton (salary plus all variable/incentive compensation – commissions, bonuses, etc), increased at a faster rate with entry level seeing a 12% gain and senior level seeing a 36% gain over the entire time period, with the biggest single year increase coming between 2014 and 2015.

From the first two charts, it’s clear that as economic conditions improved in 2015 and 2016, companies increased employee pay but put greater emphasis on incentive compensation, decreasing the percentage of total pay contributed from base salary (base salary increased, yes, but incentive compensation increased more). The Base Salary as % of Total graph shows this impact, and that it affected non-entry level roles the most (base salary dropped from being > 80% of total compensation to around 70% of total comp). In 2016 the trend shifted back a bit, with base salary again gaining a bit of emphasis. This is likely due to the focus we all had last year on the proposed FLSA changes and new salary requirements.

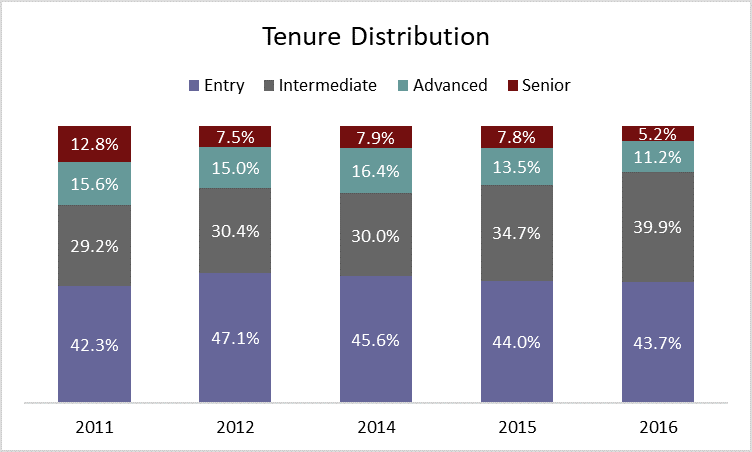

In 2011, we collected data from 58 companies for 390 employees in this role. In 2016, we had data from 86 companies for 918 employees in this role. Over this time, the percentage of employees in the entry level position has remained fairly steady, but the percentage at the advanced and senior level has decreased. This trend, along with the 10% increase in percentage of employees at the intermediate level and the increase in pay for the advanced and senior levels, represents the most significant finding for predicting the future of compensation – at least for this role.

Before considering the implications of this change we need to examine the potential reasons for the change. Percentages are tricky things. A reduction like this may make it seem there has been a mass exodus of senior level employees, which would be bad for the industry. However, in terms of raw data the number of employees at these levels has not changed much…but the number of employees in the lower levels has increased dramatically. This is partly because we’ve added nearly 30 more companies to our survey set, giving us data on an additional 528 employees, many of which are in the first two levels of experience.

There is another factor. In the last several years, there has also been a noticeable trend to shift to specialized roles from the one-person does everything “Cradle to Grave” broker role. In 2011, 6% of employees were matched to the “Cradle to Grave” broker role. In 2016 this percentage dropped to 3%. This means there is a need for more people doing the specialized “carrier sales” role than existed in the past, and this need will be filled with less tenured staff.

What’s going to happen to compensation in 2018?

Using my crystal ball (and my knowledge of this industry from working with more than 100 brokers over the last 10 years), my best guess is that our nearly full-employment economy means those employees with 3-5 years of experience will be in extremely high demand and will be tempted to shift companies for better offers. The median “advanced” salary rate is almost $45k with total compensation of $60k. Plan for this to be the minimum pay expectation if you are looking to hire employees with more than 2 years of industry experience, and plan now to provide increases in salary and incentive opportunity based on both tenure and merit if you want to keep your best intermediate level employees with you. Telling them they can “make their own raise” by increasing their gross margin and volume is probably not going to cut it when another company is offering a salary that is $5,000 to $10,000 higher along with a more exciting and motivating incentive plan.

On the entry side, I don’t see much in the way of change in compensation levels for these roles – I would expect a modest 2-3% increase that keeps up with external offer rates for recent college graduates going into any non-degree specific job. But I would not spend your hard-earned dollars on much of an increase in your starting offers, instead – focus the dollars on those with 2 or more years of experience.

Now for a bit of advice. It may be tempting to “throw money at them” to get employees to accept the offer, especially if they have experience. But be careful. I remember 2009, do you? You don’t want to be in a situation where you have exposed your company to excessive fixed costs in the form of high salaries that cannot be covered. However, this answer is NOT to put them all on highly variable commission plans, either. I’ve spent much of the last 10 years unwinding poorly designed 100% commission plans (and they are horribly hard to unwind). If you use a straight commission rate, you are locking yourself into that rate for nearly eternity. It’s very hard to reduce a commission rate no matter the soundness of the logic and the economics behind doing so. Instead, if you are using a commission approach (vs a goal-based incentive) you must always use a productivity expectation that triggers a rate change. This gives you something you can change that is NOT the commission rate. It gives you flexibility to adjust your compensation payouts when other factors come into play – such as a change in TMS system, a change in organization structure and roles, increased marketing, or even a marked increase in FEMA loads driving volume up to short-term extreme levels. You need to be able to ensure you are aligning pay to the market rate for the job, but not paying more than you need to. Instead of overpaying, the dollars saved should be retained by management for investment or savings, for the next rainy day.

1Prosperio Group produced reports for the TIA in 2012 (for 2011), in 2013 (for 2012), at the end of 2014 (for 2013/2014), in 2016 (for 2015), and in 2017 (for 2016).

-----

A version of this article was published in the September 2017 issue of The Logistics Journal.

Beth Carroll is the owner of Prosperio Group, a compensation consulting firm that helps clients get the maximum ROI from their compensation dollars by helping them develop compensation structures and incentive plans that align with company goals and objectives and increase motivation and urgency among staff. Beth has worked with over 100 of our members since 2007 and is a regular speaker at the annual conference. Prosperio also administers the TIA compensation survey: MeasureUp. Copies of reports can be ordered from the members’ section of the TIA website. Beth can be reached at beth.carroll@prosperiogroup.com